A premier group captive insurance program owned and operated by commercial roofers.

NARI Alignment.

NARI is comprised of commercial roofing contractors across the U.S. with “Best in Class” fall protection, safety services, subcontractor management and claims management.

KNOW MORE.

ABOUT US

- Commercial Roofing Contractors

- Founded in 2007

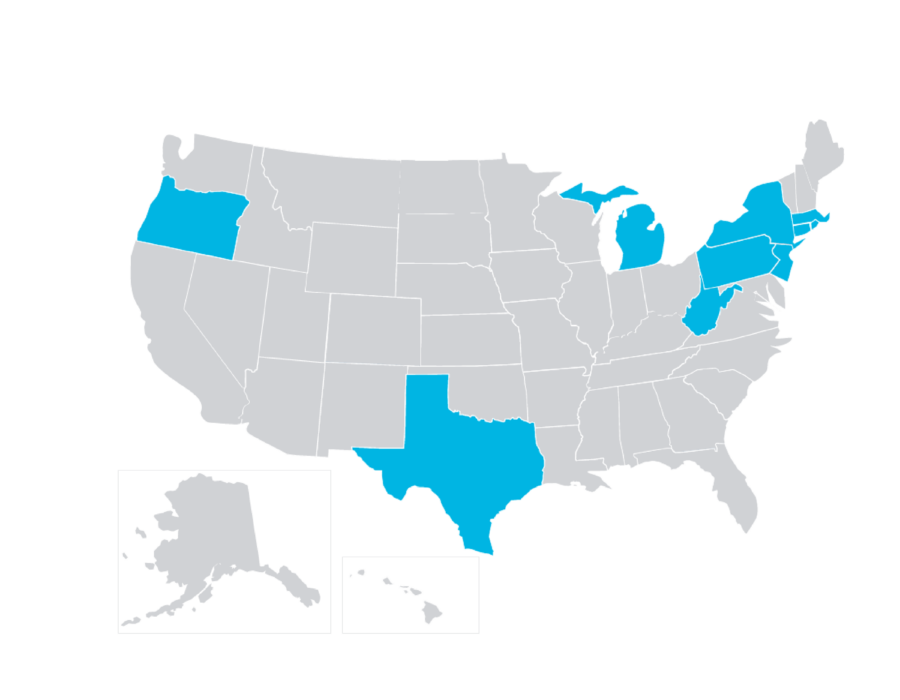

- Nationwide Footprint

- Captive Domiciled in Vermont

- Primary Policies Issued by Arch (A.M. Best A+ XV)

- Workers’ Compensation

- General Liability

- Auto Liability

- Excess Liability Policies Issued by Navigators (Hartford)

- Ancillary Lines:

- Professional Liability

- Builder’s Risk

- Inland Marine

- Property

- Surety

OWNERSHIP STRUCTURE

- Subscriber controlled: through owner committees (finance, claims, loss control and underwriting)

- Sharing best practices: becoming a safer and better roofer

- Transparency: knowing where, how and when your insurance dollars are spent

- Unbundled “Best In Class” service providers: loss control, claims management, construction brokers, program management, and oversight

DESIGNED BY AND FOR COMMERCIAL ROOFING CONTRACTORS

Subscriber Benefits

- Cost Transparency

- Peer Collaboration

- Customized & Proactive Loss Control

- Stabilization of Insurance Costs

Subscriber Services

- Safety Consulting

- Claims Management

- Policyholder Services

- Contract Review

Access To

- Underwriting Profits

($8M since 2019) - Investment Income

($33M in asset size)

OWNERS’ TESTIMONY

“I initially joined NARI for the pricing stability that the Group brings. Now, as a member, I am exceptionally happy with the superior service provided in the way of claims management, contract assistance, simple day-to-day responsiveness, and their commitment to safety. I strongly believe being a part of NARI is good for my business.”

– Doug Reader, R&B Roofing

OWNERS’ TESTIMONY

“We are roofing experts, and not insurance experts. [However,] NARI has experts in insurance that help us run our business. We do that through our committees. It gives you real ownership and control and the ability to direct how claims are handled.”

– Kristine Cook Lindsey, Vice President & Owner, CEI Group

OWNERS’ TESTIMONY

“Working with the committees and the Subscriber Advisory Council, you see where all the funds come from, you see the budget used to run the company, and you know where all the premium dollars go. There’s full disclosure of what’s going on. It’s a very tight nit group of people who have the same common goals who can work together to build a structure that works the best for everyone.”

– Wes Nickell, Vice President of Finance, Kalkreuth Roofing & Sheet Metal

CURRENT SUBSCRIBERS.

- Barrett, Inc.

- Carlson Roofing

- CEI Group

- CR Systems

- Furey Roofing

- Gilbert & Becker

- Klein & Sons

- JHS Restoration

- Kalkreuth Roofing

- Macri Roofing

- MONPAT Construction

- New England Masonry

- Patrick J McKenna

- R&B Roofing

- R&S Construction

- R.B. Hash

- Russell Roofing

- S.R.C. Roofing

- Tech Roofing

- The Fania Roofing Company

- Wolkow Braker